As summer settles in Qatar, the weekend lineup offers an exciting mix of cultural celebrations, thrilling activities, and family-friendly entertainment that reflect the nation’s vibrant lifestyle. Whether you’re a local or a visitor, this weekend is packed with opportunities to explore Qatar’s rich traditions, dynamic art scene, and natural wonders.

With many events scheduled during cooler evening hours, it’s the perfect time to get out and enjoy what the country has to offer. Here’s a detailed overview of the main events happening from June 25 to 28, 2025, to help you plan a memorable weekend.

Bangladeshi Mango Festival

Souq Waqif’s Eastern Square will host the first Bangladesh Mango Festival from June 25 to July 1, 2025, daily between 4:00 PM and 9:00 PM. Organized by Souq Waqif management and the Embassy of Bangladesh in Qatar, this free event invites visitors to enjoy a variety of mangoes directly imported from Bangladesh, known for their exceptional sweetness and aroma. Guests can sample fresh mangoes, purchase different varieties, and explore mango-based products like juices, jams, and desserts.

The festival also features cultural performances, traditional music, and art that showcase Bangladeshi heritage, creating a lively atmosphere for families and food lovers. Set within the historic Souq Waqif, the event blends Qatari charm with Bangladeshi culture, strengthening ties between the two countries.

The festival is easily accessible by public transport and offers free entry, making it an ideal spot for an evening of tasting, shopping, and cultural enjoyment in Doha.

Summer Bazaar

The Summer Bazaar continues at Hall 5 of the Doha Exhibition and Convention Centre from June 25 to July 9. Open daily from 10am to 10pm (with Fridays starting at 3pm), this bustling marketplace features a diverse collection of vendors selling everything from artisanal crafts and fashion to toys and gourmet foods.

Designed to cater to all ages, the bazaar includes dedicated play areas for children and a variety of food stalls offering international flavors. It’s an ideal destination for shoppers and families looking to enjoy a lively and colorful market experience.

Scoop by the Sea

Running until August 13, “Scoop By The Sea” invites families and visitors to enjoy a range of activities at West Bay North Beach. Operating weekdays from 10am to 6pm and weekends from 8am to 6pm, this event features live performances, water sports, creative play zones, inflatable parks, and wellness sessions. It’s a perfect spot for those seeking a fun-filled day by the sea, combining relaxation with adventure in a scenic beachfront setting.

Lusail Karting

For those craving speed and excitement, the Lusail International Circuit’s Public Karting program is open Wednesdays through Saturdays from 6pm to 11pm, starting June 11. The 900-meter track accommodates up to 15 karts simultaneously, with each session lasting 12 minutes. Both solo racers and groups can book sessions, making it a great option for friends, families, or motorsport enthusiasts. The circuit offers a professional and safe environment, and booking in advance is recommended to guarantee your spot.

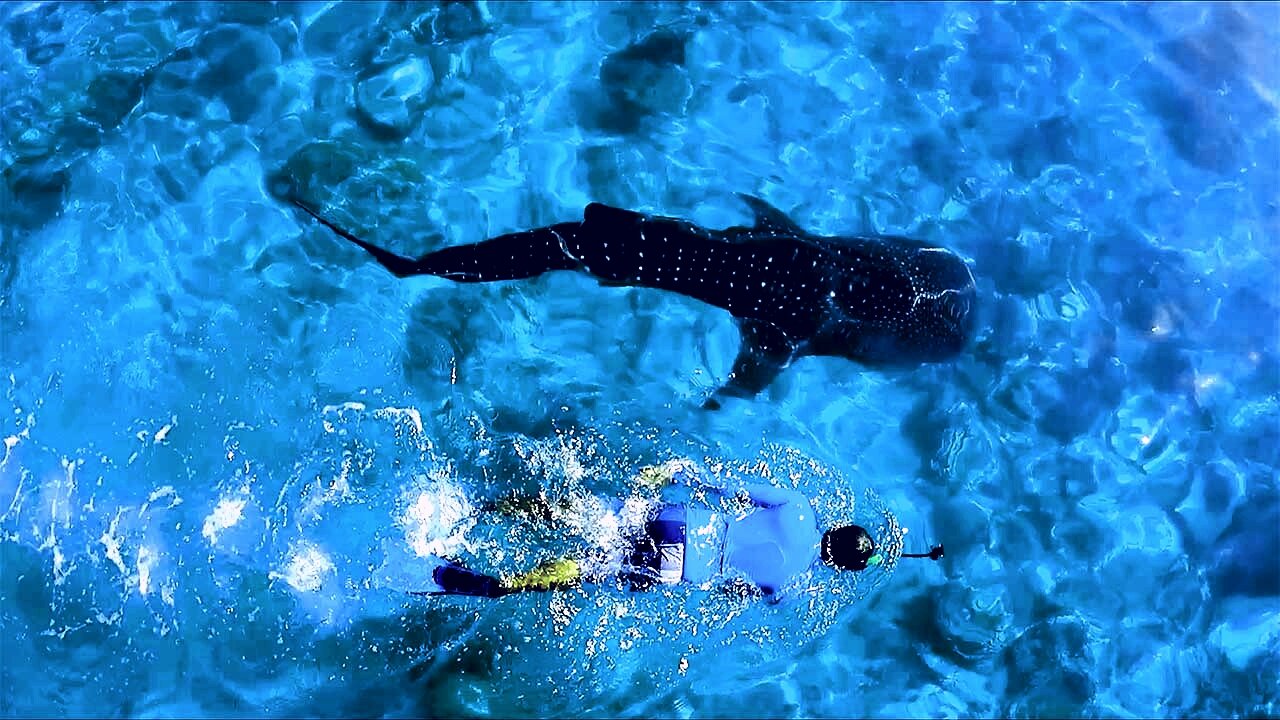

Whale Shark Watching

Nature enthusiasts have a unique opportunity to witness the majestic whale sharks during their season, which runs until September 19. Tours depart every Thursday, Friday, and Saturday from 6am to 2pm at Al Ruwais Port in northern Qatar. Guests board high-speed catamarans to observe these gentle giants feeding near the water’s surface. This rare encounter offers a fascinating glimpse into marine life, with expert guides providing insights to ensure a safe and educational experience suitable for all ages.

Al Jabala Theatre Show

On June 26 and 27, the Al Jabala Theatre Show will be performed at U Venue. This Arabic-language production combines elements of comedy and horror within a compelling narrative, delivering both entertainment and thoughtful storytelling. The show has generated significant interest among theatre fans, and tickets should be secured in advance to avoid disappointment.

Year End Art Show

Art lovers can explore the “Art and Design Now: Year End Show” at M7 Gallery, running until July 5. Open Saturday through Thursday from 11am to 9pm and Fridays from 3:30pm to 9pm, the exhibition features innovative works by graduating students from VCUarts Qatar. Each piece reflects fresh perspectives and creative experimentation, offering visitors a glimpse into the future of Qatar’s art and design scene. Admission is free.

Food and Feasting Exhibition

This major exhibition at the Museum of Islamic Art, open until November 8, explores the rich culinary traditions of the Islamic world from historical times to today. Presented in collaboration with the Los Angeles County Museum of Art (LACMA), the exhibit features artifacts, stories, and multimedia displays that highlight the cultural, religious, and social significance of food and feasting. Visitors are encouraged to register in advance to experience this immersive journey into Islamic heritage through the lens of cuisine.

Latinoamericano Exhibition

Until July 19, the National Museum of Qatar presents “LatinoAmericano,” the region’s first large-scale exhibition of Latin American art. Featuring over 170 works spanning from 1900 to the present, the exhibition is organized into six thematic sections and draws from the Museum of Latin American Art Buenos Aires (Malba). It offers a rare opportunity to explore Latin America’s rich artistic history and contemporary creativity. Entry is free but requires advance ticket reservation.

Wafa Al-Hamad Retrospective

Mathaf: Arab Museum of Modern Art is hosting a retrospective exhibition honoring Wafa al-Hamad, a trailblazing Qatari artist, educator, and designer. Open until August 9, this exhibition celebrates her 40-year career and her significant contributions to Qatar’s cultural landscape. Visitors can explore a wide range of her works and gain insight into her artistic vision. Admission is free with prior registration.

This weekend in Qatar offers a vibrant mix of experiences—from savoring exotic mangoes and racing on a professional karting track to exploring world-class art and encountering magnificent marine life. Whether you’re seeking cultural enrichment, outdoor adventure, or family fun, the country’s diverse events promise something memorable for everyone.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)